Water bills can be a significant expense for homeowners, especially during times of drought or when water rates are on the rise. However,…

Money Save Solutions

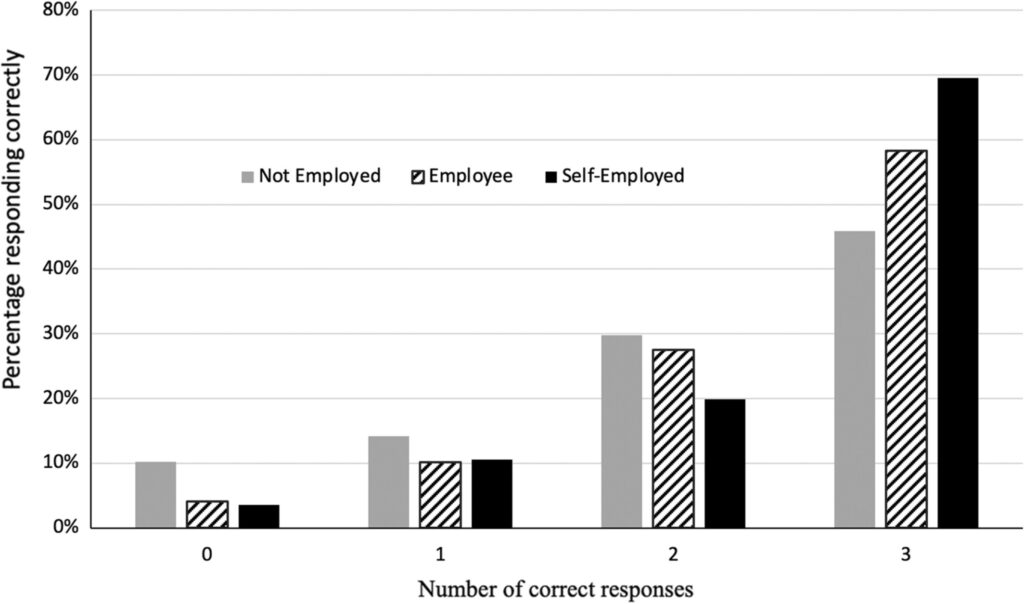

Financial literacy plays an integral role in the success of self-employment, as it empowers individuals to make informed decisions about their finances. However, research has…

Divorce can be a difficult and emotionally draining process. Amidst all the stress and change, it can be easy to forget about important financial matters…

The world of insurance is vast, encompassing a wide range of products and services that aim to protect individuals, businesses and assets from the financial…

Good communication is an essential tool for success in any aspect of life, be it personal or professional. It is a skill that requires practice…

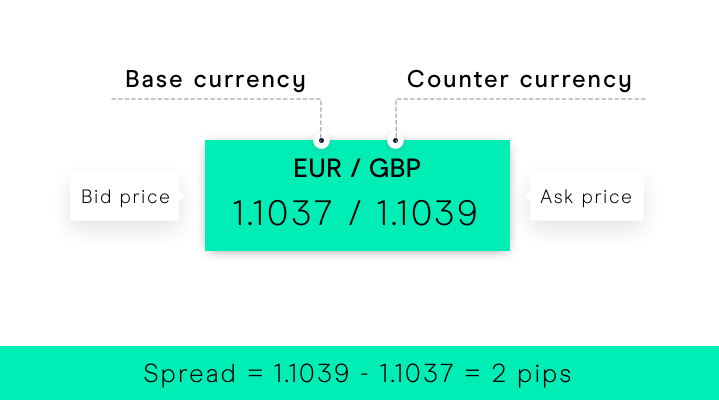

Investing in foreign currencies can be a great way to diversify an investment portfolio, but it’s important to understand the basics before getting started. One…

What Is Trading Spreads Trading spreads offer traders a great opportunity to take advantage of the markets by utilizing the power of leverage. It can…

Accounting and finance are two closely related fields that many people often confuse. While the terms are often used interchangeably, there are key differences between…

Financial modelling in Excel is an essential skill for any finance professional. It is a powerful tool that allows users to create detailed financial models…

Business ethics is a complex topic that has become increasingly important in today’s world. It is not just about making sure that companies abide by…